Overview:

→ Probability of Recession: 20%

→ NFIB, CPI, PPI

→ Bonds

→ Equities

→ US Dollar

→ Oil

→ Portfolio Strategy and Positioning

→ Personal Allocation

NFIB, CPI, PPI

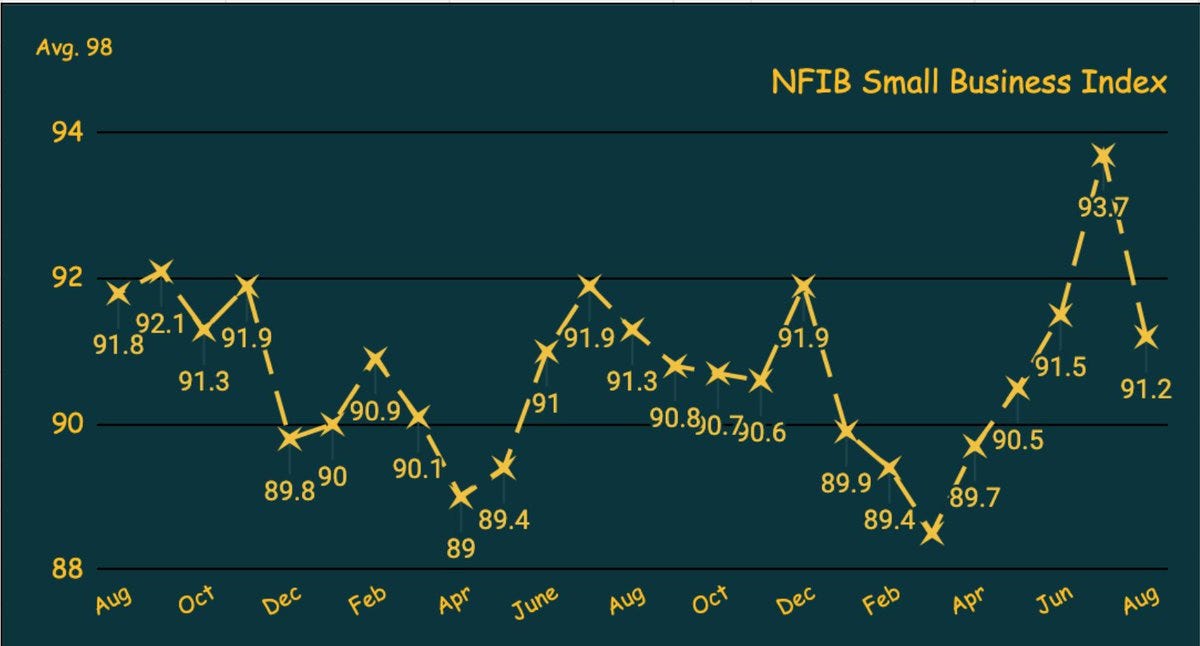

NFIB: 91.2. "Inflation remains the top issue among small business owners, with 24% of owners reporting it as their top operating issue. Sales expectations plummet and cost pressures increase. Uncertainty among owners continues to rise as expectations for future conditions worsen"

Small businesses are too naive to realize that sales have actually slowed because they look at the top line without adjusting for inflation. Margins are down because of rising costs, but the revenues are up due to inflation. In their mind, the issue is not slowing revenues or sales, but inflation and rising costs preventing them from making more profit.

The frequency of positive profit trends was -37%.

20% plan to raise compensation in the next 3 months.

Raising average selling prices fell to -20%.

40% reported job openings they could not fill.

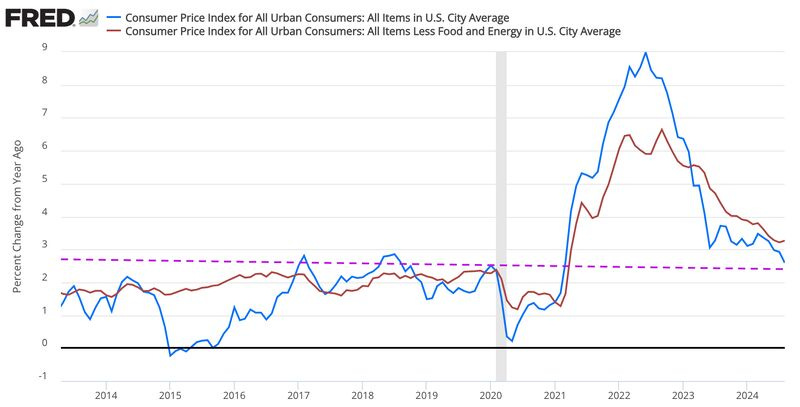

CPI and Core CPI came in roughly in line with core showing a slight increase. Historical inflation averages 2% to 2.5%.

CPI (M/M): 0.2%

CPI (Y/Y): 2.5%

CPI Core (M/M): 0.3%

CPI Core (Y/Y): 3.2%

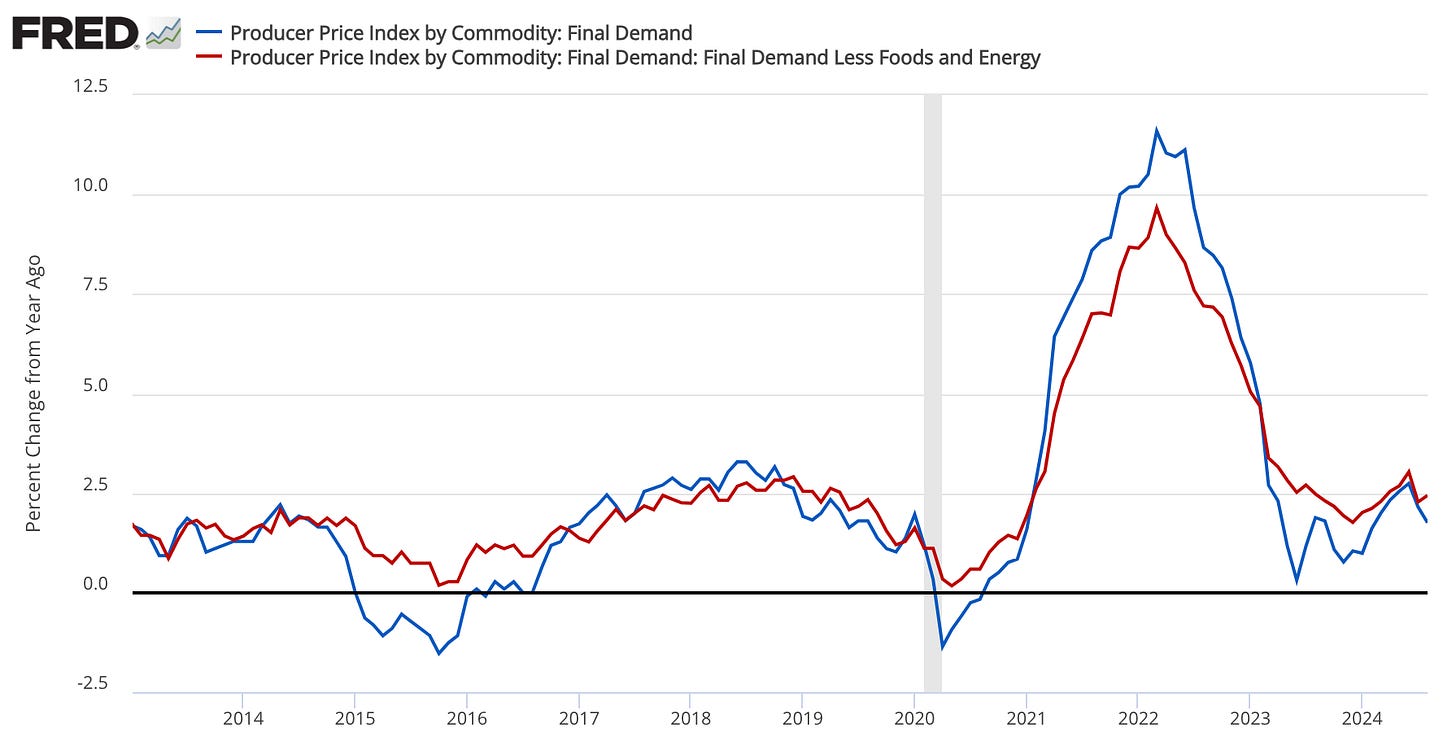

PPI & Core PPI both came in a little higher that expected but remains in a downtrend and around historical levels, similar to CPI.

PPI (M/M): 0.2%

PPI (Y/Y): 1.7%

PPI Core (M/M): 0.3%

PPI Core (Y/Y): 2.4%

None of these data points are signaling any confusion for the Fed which remains on track to lower interest rates by 25 bps next week.

Bonds

The current economic environment, characterized by rate cuts and slowing growth, is exerting downward pressure on bond yields. I maintain a short term target of 3.95% but yields should remain pressured waiting for the growth slowdown fears to dissipate and stronger economic data. When that happens we should see both yields and stocks up together. Given the anticipated deceleration in economic growth, the neutral rate is likely to be significantly lower than current market consensus, around 2.50% - 2.75% adding pressure on bond yields. Looks like financial media is rallying people to expect a 50 bps cut, which they will only use to rug bonds later when we get a 25bps. Yields are screwed long term as inflation is as good as dead. No doubt that any rally in yields, PMs will use the opportunity to cover their short bond position.

Equities

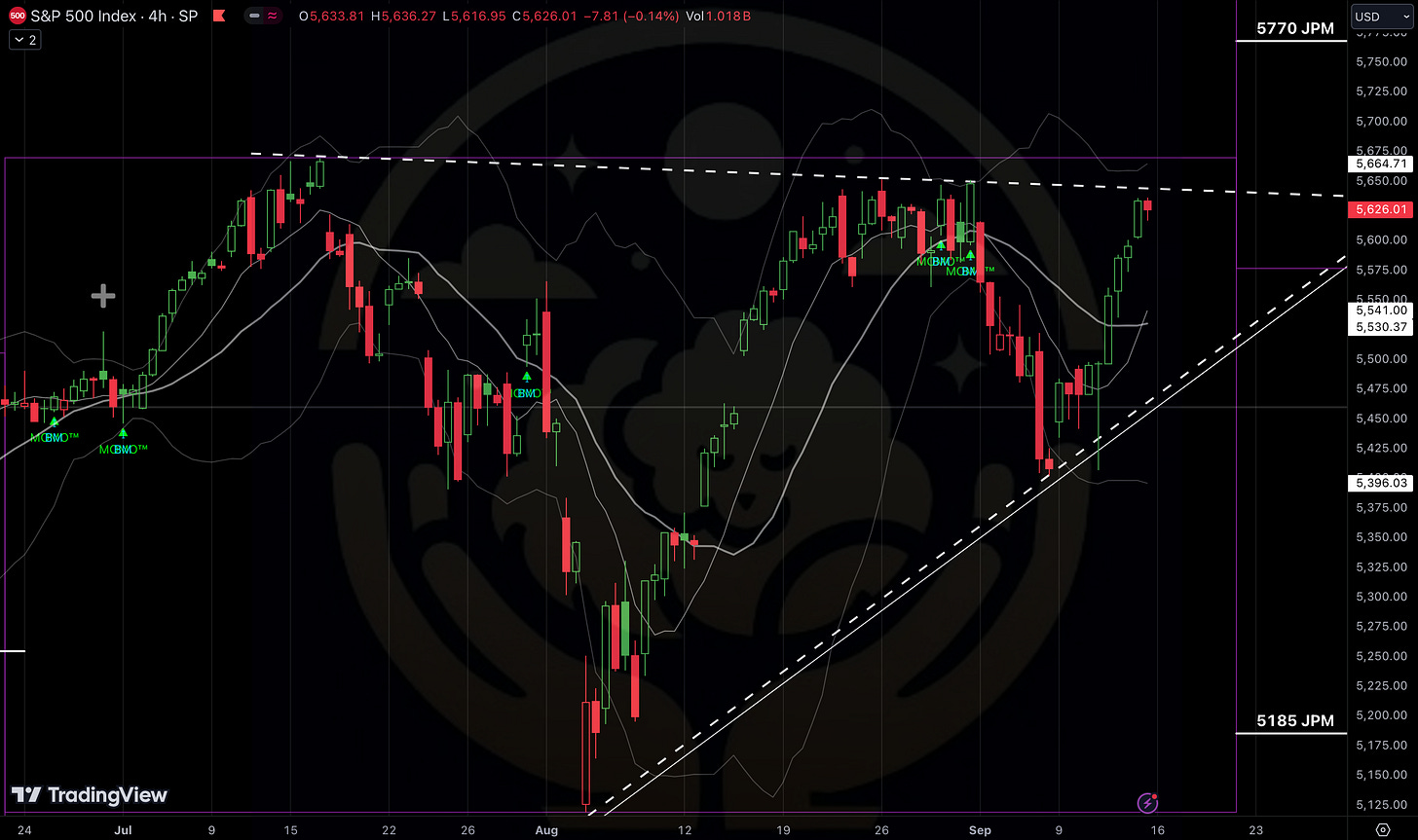

Equities look bullish here especially now that we got a SuperMomo trigger, upside targets remain 6000 and as high as 6200. Shorter term to conduct some chart price action surgery, I expect the S&P to continue churning upwards on the 1 hour chart will minor pullbacks to both its 10 & 20 sma, until we get a massive overshoot above the 4 hour Bollinger Band. From there, we can see a small pullback or consolidation, until the next momentum wave kicks in. SuperMomo is now in charge.

Dollar

The U.S. dollar is likely to continue its downward trend due to a couple of factors. Lower interest rates, relative to other major economies, have reduced demand for the dollar as investors seek higher yields elsewhere. Additionally, slower economic growth and a scorching national debt from recent and expected government policies, are putting pressure on the dollar. The absence of global geopolitical risks has led investors to favor riskier assets, further driving down the dollar, which is often seen as a safe haven currency. Longer term I expect DXY to head towards $93.

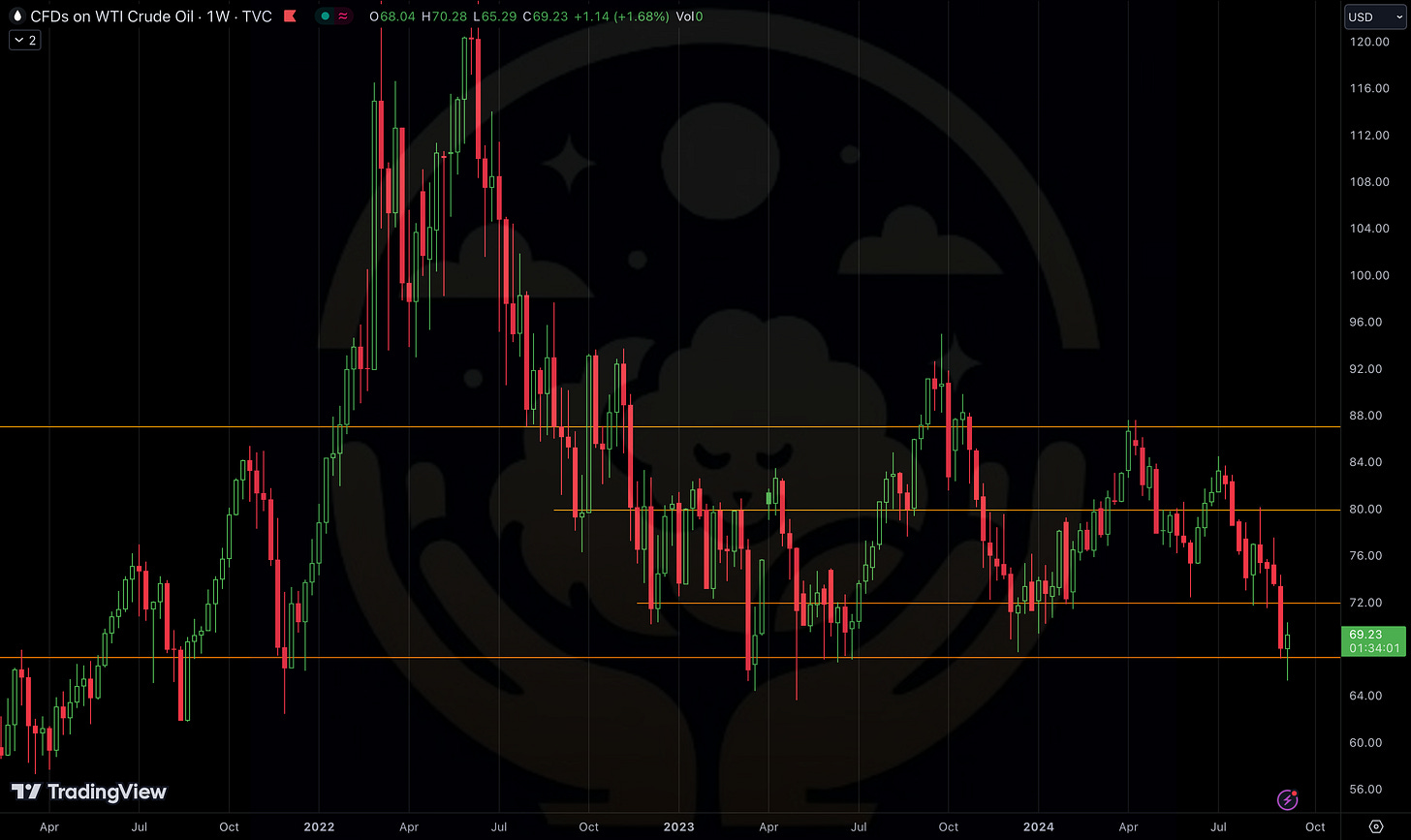

Oil

The recent decline in oil prices is a significant factor contributing to the overall disinflationary trend. This price reduction offers valuable insights into the current state of global economic growth. Based on my analysis, oil prices are likely to stabilize around the $67, as highlighted two weeks ago. Until global growth concerns and recession fears subside, oil prices may remain within this $67 - $72 range. Once these anxieties dissipate, I anticipate a rebound towards $76 per barrel. The recent downward trend in oil prices will continue to support disinflationary pressures throughout the remainder of 2024. Longer term, oil’s supply and demand dynamics will always be in control of the commodities price.

Portfolio Strategy and Positioning

Strategy remains tilted defensively as we wrap up the third quarter into the end of September with increasing allocation towards discretionary and more risk-on sectors that benefit from the rate cutting cycle into the next earnings season (November).

Allocating towards sectors that will benefit from the rate cutting cycle is appropriate such as: Real Estate (XLRE), Technology (XLK), Industrials (XLI), Financials (XLF), Consumer Discretionary (XLY), The Russel 2000 (IWM), and high quality small caps (RWJ) that should perform very well heading into the next earnings season.

Real Estate: HD, Z

Financials: JPM, C, GS

Discretionary: DIS, TSLA, AMZN, YETI

Technology: GOOG, NVDA, MSFT,

Industrials: CAT

Other: IWM, RWJ

Personal Allocation

My portfolio allocation remains tilted defensively but I am also increasing allocation into the sectors I believe will outperform in the next quarter (mentioned above). Last week I added GOOG to cover the tech sector, this week I added JPM to cover the financial sector, and increased exposure in SPY calls as SuperMomo was triggered.

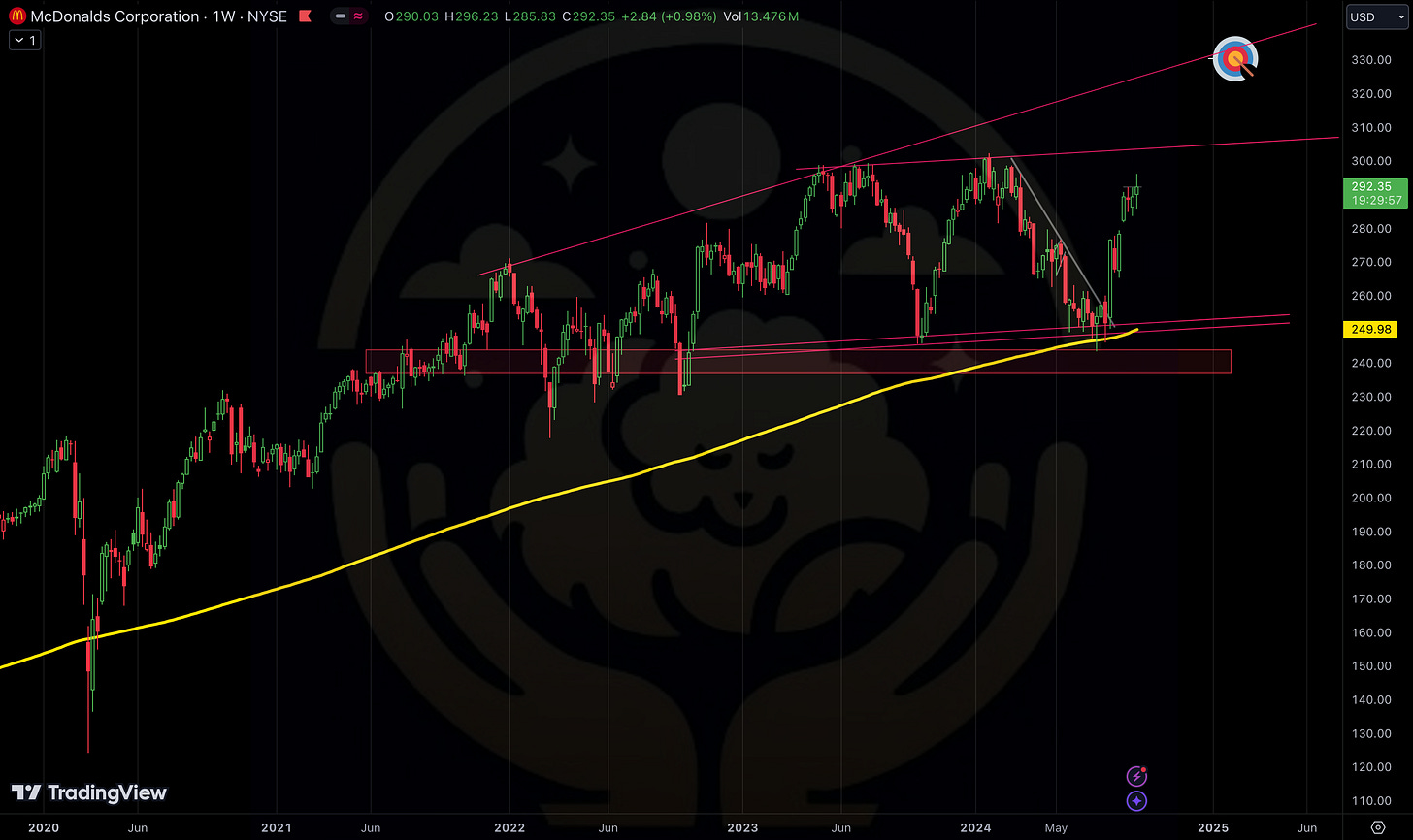

I am actively watching PEP and MCD here as I anticipate another small rally in those names so I can re allocate in favor of more risk on names like the ones mentioned above, and SPX. (To reduce or to exit entirely is the question. I am unsure yet as their long term charts look very bullish to me. (charts below)

GROWTH & NBER RECAP BELOW UNDER “ECONOMIC MODELS” SECTION

(Economic models get updated again at the end of the month)

DISCLAIMER: The analysis is intended for educational and informational purposes about investments and does not constitute investment advice. It reflects my personal trading and may not be suitable for all investors. Always conduct your own due diligence before making investing decisions. Individual investment decisions should be made based on personal circumstances and risk tolerances. Always consult with a qualified financial advisor before making any investment decisions.