Markets have finally exited the window of weakness which as expected has proven to be relatively tame this month. Seasonality weakness is expected by many, however, election years have a slightly different path (discussed below). As we wrap up the third quarter I expect markets to defy the seasonal weakness and finish the quarter higher.

We remain in the “window of weakness” for another week. The approaching Labor Day holiday and with the rate cutting cycle on hand, there are compelling reasons to maintain a bullish outlook. While we may experience further volatility in the short term, I believe this period of market weakness (if any at all) will be short lived.

Election Seasonality VS September Seasonality

The August to October seasonality weakness is no joke. I had doubts, but it's consistently bad every year. Election years are the most tame exceptions that typically see only a 6% correction and so far we got a slightly bigger one as the S&P 500 saw a 10% correction and the Nasdaq dropped 16%. Only one election year has managed to be fully green. Most other years started to rebound around mid-September.

Topics:

→ Overview

→ Economic Models

Growth Outlook

Leading Growth Index (LGI)

Consumption Forecast:

NBER Indicators

Consumption during elections

→ Weekly Update

Bonds & Neutral Rate

Equities

Portfolio Strategy

Personal Positioning

Overview

As we conclude the third quarter, the market outlook remains optimistic for now. Historically, equities tend to exhibit strength leading up to the US November elections. As the rate cutting cycle unfolds, we anticipate a shift in sector performance, with sectors poised to benefit from lower interest rates such as Real Estate (XLRE), Technology (XLK), Industrials (XLI), Financials (XLF), and Consumer Discretionary (XLY) should begin to outperform. Defensive positioning is anticipated to remain a viable strategy through the end of this quarter before a more risk on approach takes place into the next earning season.

ECONOMIC MODELS

Growth Outlook

A modest economic slowdown is expected to continue heading into the third quarter and then further accelerate in the fourth quarter. The potential for immediate impact from rate cuts is now more necessary than ever. Watching how growth reacts to lower rates over the next two quarters is critical. There is significant risk building that if growth does not rebound from the rate cuts it will alter the economic path.

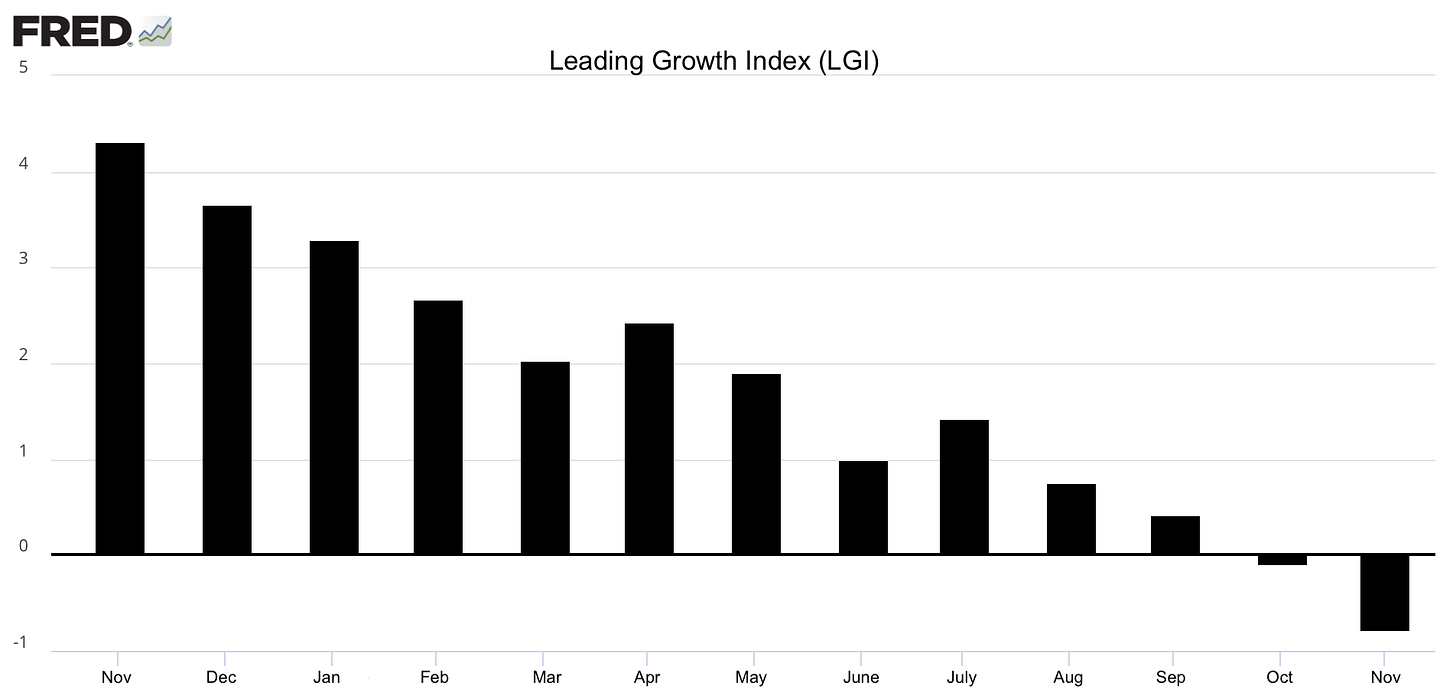

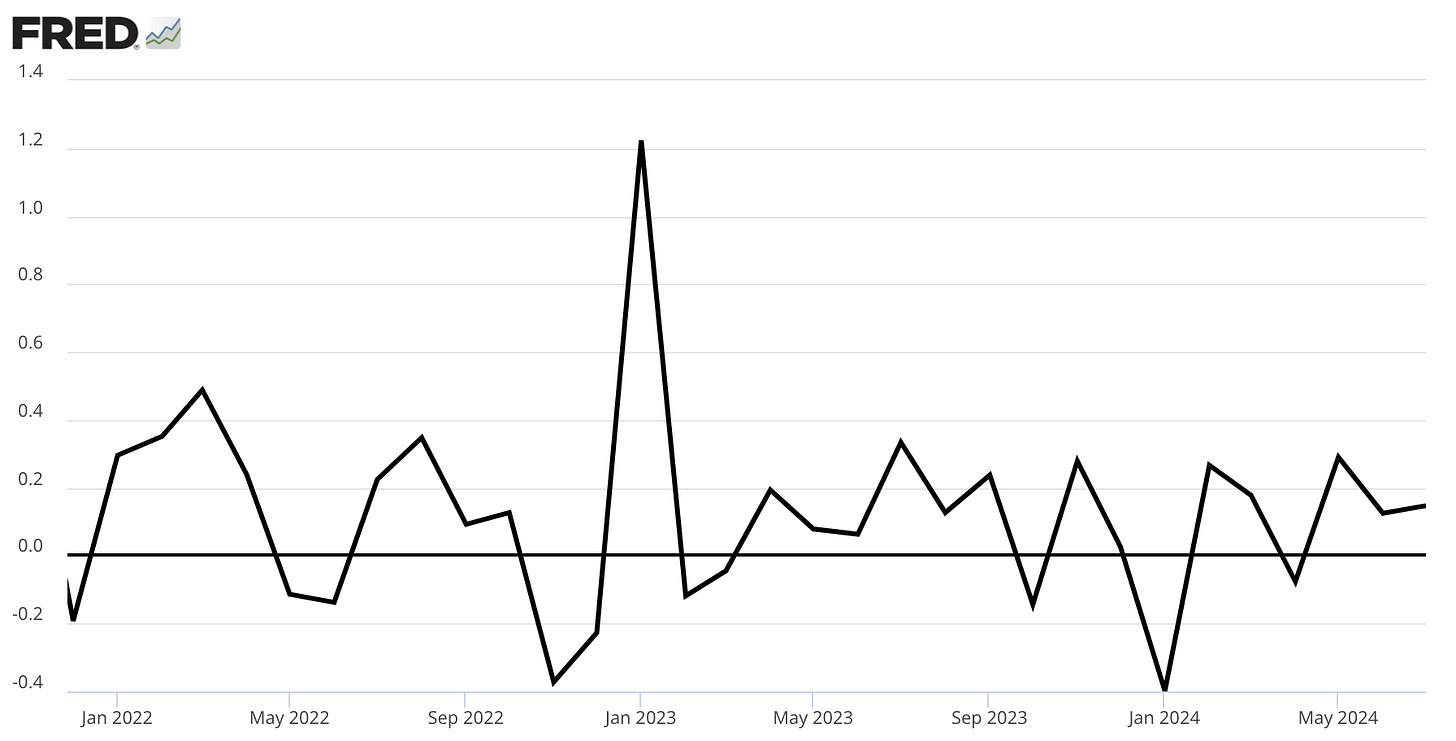

Leading Growth Index (LGI)

The Leading Growth Index forecast has turned negative, signaling growth to decline by -1% in November of the fourth quarter. What happens from here is critical. This deterioration in growth could have far reaching implications for employment and the overall economy. The optimistic view is to hope the rate cuts are not too late and that they also have a minimal lag effect to turn the economy back on. As this is a forecast, it is not expected to show up in the data until November or December just in time for the next earnings season which begins end of October and goes on until mid-November. One negative print is not the end of the world here but we are not trending in the right direction. Sustained negative prints in the months ahead will be bearish the economy and stocks. Discussing hedges and a bear market will be prudent.

Historical LGI from 2021 to 2022 can serve as a blueprint. From the first negative print which was in September at that time, it took three to four months for the market to eventually top out in November/December before the bear market of 2022 started. This makes sense here as again the forecast is for the next quarter. Additionally we were not in a recession for the entirety of that bear market as rGDP remained positive and yet assets sold heavily regardless.

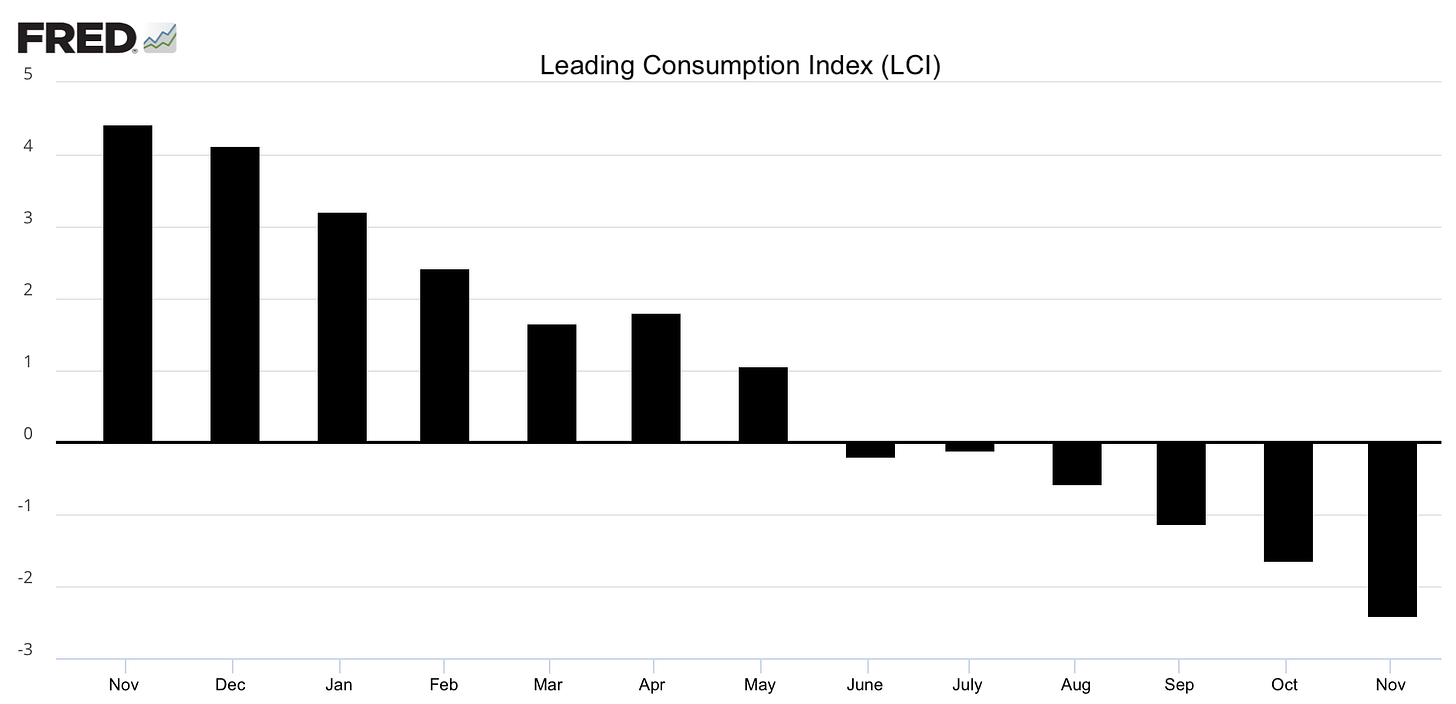

Consumption Forecast

The Consumption Forecast continues to decelerate even faster now into the heart of the fourth quarter, forecasting -2.4%! In response to weakening consumption, and therefore lower inflation, the Fed has indicated the start of the rate cutting cycle. This will aim to hopefully stimulate economic activity and mitigate a broader economic slowdown. As a consequence, recent GDP data suggests there’s strong demand for investment as lower rates make the cost of financing easier. Implications arise if this anticipated demand does not materialize into year end and early next year.

GDP Q2 Revision:

Consumption: +1.95% (65%)

GPDI: +1.31%

- Fixed Investment: +0.53%

- Inventories: +0.78%

Net Exports: -0.77%

Government: +0.46%

Connecting the pieces

One negative print is not an immediate risk off indication. Sustained negative forecasts will result in lower growth but with the potential for increased investment from lower rates may very well keep rGDP positive throughout this deceleration. We can have a bear market without a recession similar to 2022 if data does not improve after the rate cutting cycle. Entering the fourth quarter its necessary to analyze GDP in depth that focuses on both consumption and private nonresidential investment to discern between a slowdown or a potential recession. As of this forecast, recession probability remains at a normal 20% level, but is increased to 35% for the fourth quarter.

NBER Economic Indicators

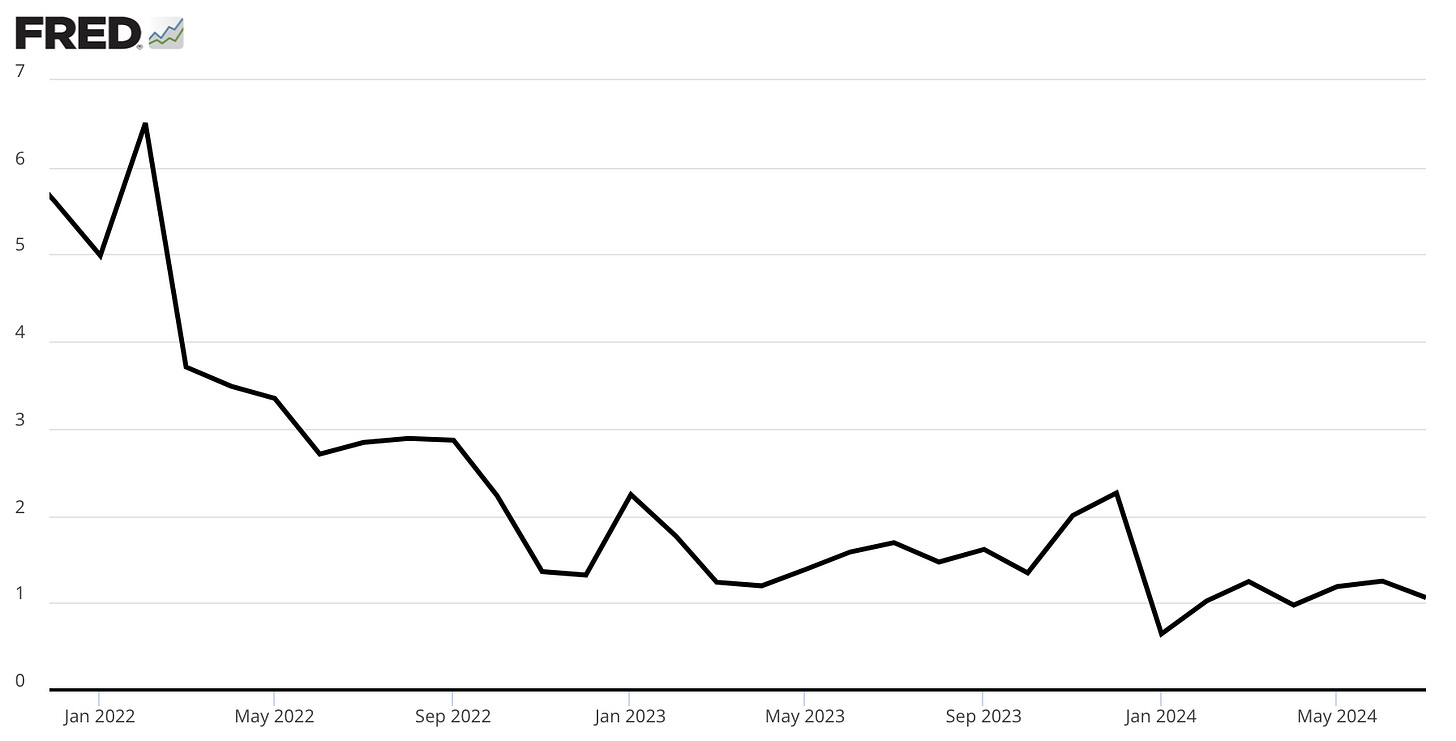

While economic forecasts provide valuable insights into potential future trends, a more current assessment of the economic landscape requires a focus on real-time data. The National Bureau of Economic Research (NBER) has established a rigorous methodology for determining economic turning points, such as recessions and expansions. By closely monitoring the NBER's designated indicators, we can gain a more precise understanding of the economy's current phase and trajectory (with a lag).

As illustrated in the above charts, the economic index has continued to recover to its pre-pandemic trend. The year-over-year growth rates within the 1% - 4% range are a characteristic of a normalized economic environment which is presently the case at 1%. While month-over-month fluctuations are expected, sustained declines can signal an elevated risk of an economic contraction. Forecasts try to anticipate this change.

Consumption & US Elections

Does consumption drop heading into the U.S. elections?

A recurring economic phenomenon, known as “Election Anxiety”, has been observed to have a temporary negative impact on consumer spending in the months leading up to the US elections. Historical data from the years 2008, 2012, 2016, and 2020 consistently demonstrate that both Real Retail Sales and Real Personal Consumption Expenditures (PCE) tend to be weaker than average during this period. Given this established trend, it's important to consider its potential influence on the current election cycle as we head into the fourth quarter. While the “Election Anxiety Effect” could add to the slowdown in economic activity we already see, it's crucial to note that it's a temporary phenomenon. This slowdown will give the Fed even more confidence that their policy is working and they may decide to deliver more cuts then currently priced in. If this slowdown is once again solely due to the “Election Anxiety Effect” we should start to see growth rebound after the election. If its something more, the risk of another looming bear market could be upon us.

Outlook

The conclusion here is that we are currently in a goldilocks situation with risks increasing towards the end of the year. Slowing growth and consumption is expected to be overlooked until the election. We will then reassess if this remains a historical pattern, or if this slowdown is something to be concerned about. Increased investments from lower rates should boost overall rGDP even as consumption stays weak. Should the expected demand not materialize in the fourth quarter and early 2025 it will become a problem. Until then, cautiously bullish.

WEEKLY UPDATE

Bonds & Neutral Rate

The current economic environment, characterized by rate cuts and slowing growth, is exerting downward pressure on bond yields. While I maintain a short term target of 4%, achieving this level will require a series of robust economic data points. Given the anticipated deceleration in economic growth and continued disinflation, the neutral rate is likely to be significantly lower than current market consensus. This is because starting from an almost perfect economic environment, (low unemployment and loose financial conditions) a potential recession will be more severe due to the limited room for further improvement. High personal debt and low savings reduces people’s cushion when a downturn occurs and makes it more impactful. Consequently, this suggests that a recessionary 10 year yield should be much lower, reflecting the higher severity and risk associated with a potential downturn originating from a currently stronger economic baseline. Therefore, the neutral rate is lower. (2.5%?)

Equities

To maintain economic growth in the latter part of the year and into 2025 catalysts will be the resolution of the US elections that create “election anxiety” and impact consumption, increased business investments from lower rates, and a return to a normal inflationary environment to boost sentiment and spending.

While there is elevated risk that this anticipated growth from rate cuts may not materialize if consumer spending is indeed exhausted. Market participants are likely to overlook this potential challenge as they focus on other economic indicators for confirmation of a slowdown. The anticipated rate cuts are poised to provide a boost in housing and other sectors while consumer spending remains under pressure.

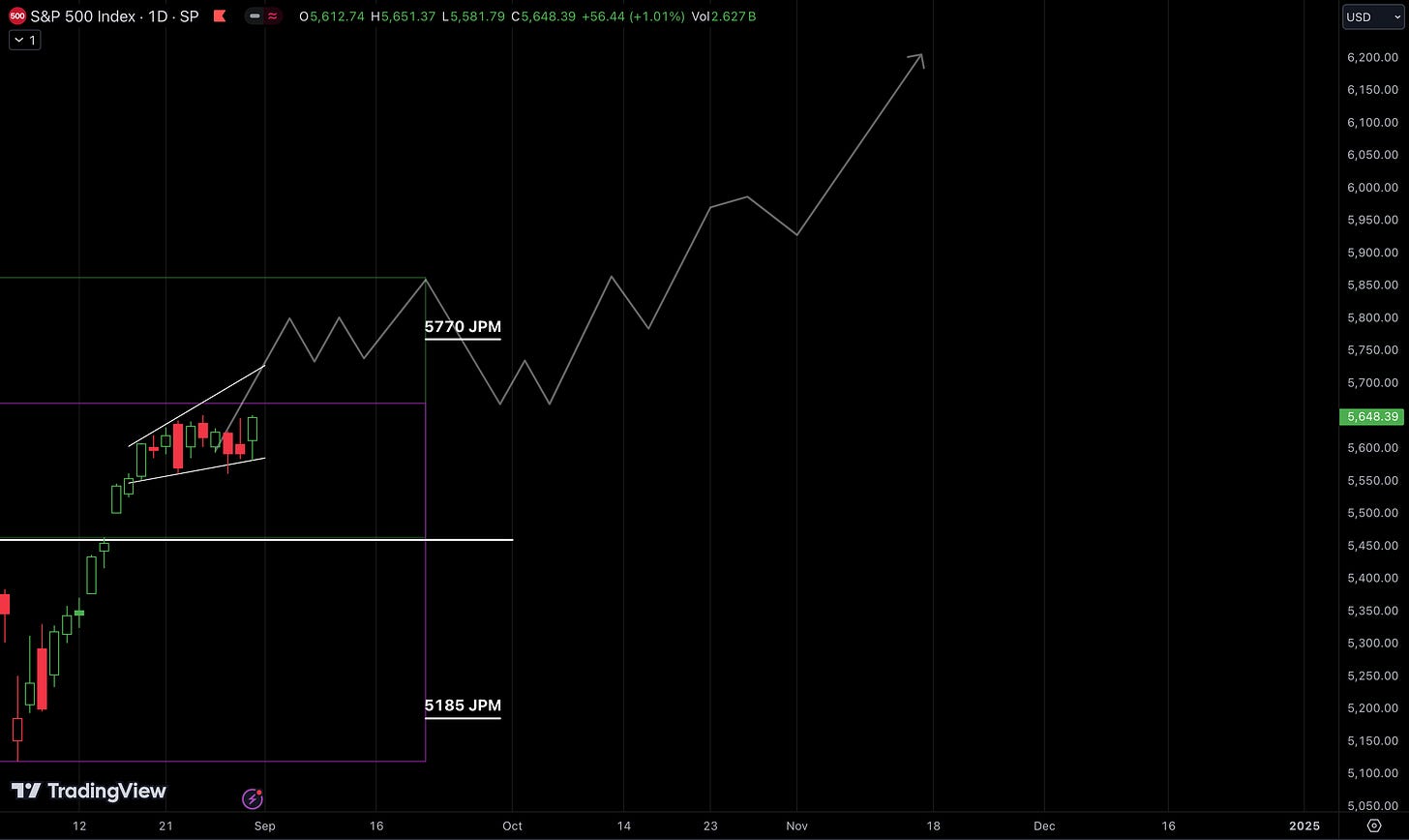

The equity markets continues to exhibit bullish momentum, with a buy the dip strategy proving effective for index-based investments. I expect a continuation into the end of the third quarter and for the S&P 500 to aim for 6200 before year end. A broad based uptrend is anticipated across all sectors, with the MAG-7 expected to lead the performance once again and other sectors start to participate as breadth improves. End of October until mid-November is the next earnings season that I expect to mark a potential top and possible beginning of a bear market, should data deteriorate.

The following depicts my expectation into December, but is by no means a guarantee!

Portfolio Strategy and Positioning

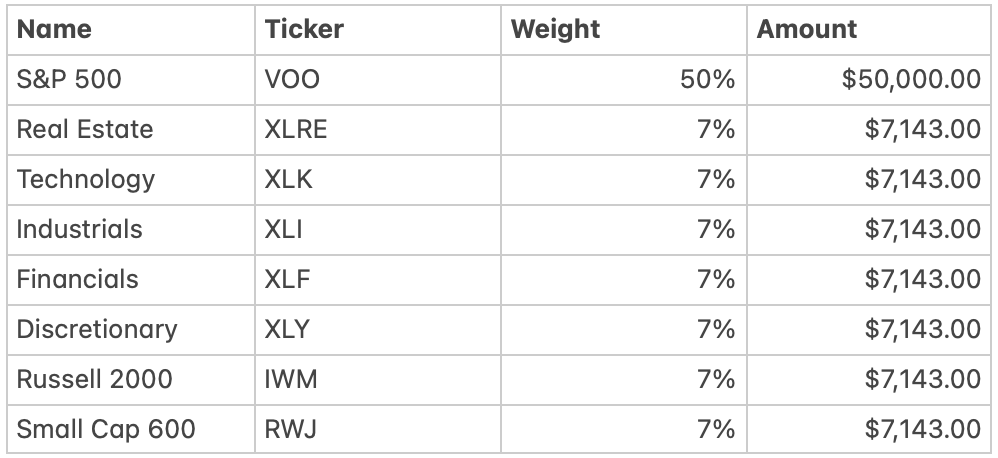

Strategy remains tilted defensively as we wrap up the third quarter into the end of September with an increasing allocation towards discretionary and more risk on sectors that benefit from the rate cutting cycle into the earnings season.

Allocating towards sectors that will benefit from the rate cutting cycle is appropriate such as: Real Estate (XLRE), Technology (XLK), Industrials (XLI), Financials (XLF), Consumer Discretionary (XLY), The Russel 2000 (IWM), and high quality small caps (RWJ) that should perform very well heading into the next earnings season.

ALLOCATION EXAMPLE

Equity allocation approach using a $100,000 portfolio value. We want to maintain a high allocation in the S&P 500 while allocating up to 50% in other sectors that are expected to outperform. (Allocations can be adjusted to suit each individual investors preference, risk profile, tax situation). The 60 / 40 portfolios are starting to perform well with the recent drop in rates and are expected to be a great diversifier now that the rate cutting cycle has begun.

PERSONAL ALLOCATION

My portfolio allocation is as follows. Weights have shifted from last week as many of my holdings did not perform great this week. The portfolio takes a big hit from PDD’s huge drop (-30%) and the minor declines from all other positions this week.

Changes:

CRWD was sold after its earnings rally.

PDD was cut entirely after its crash.

TSLA weight increased this week.

BITX added on Bitcoins drop to 59,000.

DISCLAIMER: The analysis is intended for educational and informational purposes about investments and does not constitute investment advice. It reflects my personal trading and may not be suitable for all investors. Always conduct your own due diligence before making investing decisions. Individual investment decisions should be made based on personal circumstances and risk tolerances. Always consult with a qualified financial advisor before making any investment decisions.