Election Seasonality VS September Seasonality

The August to October seasonality weakness is no joke. I had doubts, but it's consistently bad every year. Election years are the most tame exceptions that typically see only a 6% correction and so far we got a slightly bigger one as the S&P 500 saw a 10% correction and the Nasdaq dropped 16%. Only one election year has managed to be fully green. Most other years started to rebound around mid-September.

The Cutting Cycle Begins

Jerome Powell did not let us down. We wanted to see the rate cutting path communicated by the Fed at today’s Jackson Hole symposium, and that is exactly what Powell delivered. While the bond market and various economists speculated on this path, it was essential to hear this development be communicated by the Fed chair. The cutting cycle begins, so what now?

LABOR REVISIONS

We got a pretty hefty BLS revision this week showing that the economy added 818,000 fewer jobs than previously reported. The largest downwards revision since 2009 has spurred a lot of fear that the economy is weaker than expected. True, however its not a signal for an imminent recession.

MORTGAGE APPLICATIONS

Mortgage applications declined -10.1% this week during one of the strongest months for the real estate market. Some allude to this as a weakening economy and signs of peril. I ask you this: If you are a homebuyer and know rate cuts are coming within the next 4 - 5 months, would you not wait for cheaper financing via lower mortgage rates?

WINDOW OF WEAKNESS

We remain in the “window of weakness” for another week. The approaching Labor Day holiday and with the rate cutting cycle on hand, there are compelling reasons to maintain a bullish outlook. While we may experience further volatility in the short term, I believe this period of market weakness (if any at all) will be short lived.

Topics:

→ Overview

→ Labor Market

→ Growth

→ Bonds

→ Equities

→ Portfolio Strategy and Positioning

Overview

As we conclude the third quarter, the market outlook remains optimistic. Historically, equities tend to exhibit strength leading up to the US November elections…..

While the rate cutting cycle is confirmed, certain sectors, such as materials, energy, healthcare, and utilities, are expected to underperform. However, these sectors are still poised for solid returns, albeit at a pace that may lag behind other more favored sectors. As the rate cutting cycle unfolds, we anticipate a shift in sector performance, with sectors poised to benefit from lower interest rates being Real Estate (XLRE), Technology (XLK), Industrials (XLI), Financials (XLF), and Consumer Discretionary (XLY) to name a few that should begin to see investment inflows.

The current defensive positioning is anticipated to remain a viable strategy through the end of this quarter, with profit taking on spikes to re-allocate positioning into sectors that are set to benefit starting in the third quarter and fourth quarter, as we await further economic data releases for clues into the strength of the economy.

Labor Market

We got a pretty hefty BLS revision this week showing that the economy added 818,000 fewer jobs than previously reported. The largest downwards revision since 2009 has spurred a lot of fear that the economy is weaker than expected. True, however its not a signal for an imminent recession. The Leading Employment Index (LEI) serves as a predictive tool for Nonfarm payroll growth. Historically, LEI growth rates exceeding 2% have correlated with payroll expansions, while rates under 2% have correlated with payroll contractions. The recent resurgence of the LEI towards 1% suggests a deceleration in the payroll declines, indicating that the unemployment rate will not be increasing exponentially to signal recession as some claim and fear.

Growth

While a modest economic slowdown is expected in the third and fourth quarters particularly in consumption, the potential is there for an immediate impact from interest rate cuts in terms of business investments as well as an increase market sentiment and consumer behavior. Closely watching how growth reacts to lower rates over the next two quarters is crucial. Decreasing borrowing costs will likely encourage investment, driving an economic recovery into year end and in 2025. However, it must be noted that there remains a risk, that even with rate cuts, growth may not fully rebound which will alter the economic and investment path. We will monitor how this develops closely. The Leading Growth Index (LGI) is updated at the end of the month.

Bonds

The current economic environment, characterized by rate cuts and slowing growth, is exerting downward pressure on bond yields. While I maintain a near term target of 4%, achieving this level will require a series of robust economic data points. Until then, yields should remain below 4%, contingent upon incoming data. Given the anticipated deceleration in economic growth, the neutral rate is likely to be significantly lower than current market consensus. As economic developments evolve to upcoming data, the 10 year yield will correspondingly reflect those changes.

Equities

To reignite economic growth in the latter part of this year and into 2025, a confluence of factors will be instrumental. A likely catalyst will be the resolution of the US elections that create “election anxiety” and have a big impact on consumption. Combined with a loosening of monetary policy through interest rate reductions, and a return to a more tempered inflationary environment may also significantly boost consumer sentiment and spending, offering a much needed stress relief and a sense of of returning back to normal.

While there is always risk that this anticipated growth may not materialize if consumer spending is indeed exhausted, market participants are likely to overlook this potential challenge as they focus on other economic indicators for confirmation of a slowdown. The anticipated rate cuts are poised to provide a recognizable economic boost in housing and other sectors (mentioned above), even if consumer spending remains under pressure.

The S&P 500 EPS estimates for 2025 are $280 from the current: $265. The 2025 consensus EPS growth is at 15%, while Yardeni has it at 14%. The estimated S&P 500 target is around $5,900 and this can overshoot or undershoot by the end of the year.

The equity markets continues to exhibit bullish momentum, with a "buy the dip" strategy proving effective for index-based investments. My initial target is 5800 before a potential period of consolidation right after the third quarter ends. I expect the S&P 500 to overshoot 6000 by year end. A broad based uptrend is anticipated across all sectors, with the MAG-7 expected to lead the performance once again.

The following depicts my expectation into year end, but is by no means a guarantee!

Portfolio Strategy and Positioning

OVERVIEW

My current investment strategy remains centered on a defensive allocation, emphasizing stocks that are less susceptible to market fluctuations during risk off or slowing growth environments. I also have several other small caps and blue chips but as smaller weights to the portfolio. A recent addition this week is TSLA, which I anticipate will become a significant holding as I rebalance my other positions.

I maintain the view that the ongoing economic growth slowdown will favor defensive and staple stocks over cyclical sectors for a little while longer. While the recent rate cuts are encouraging, they are not sufficient to warrant a full shift in my investment strategy but a rebalancing of my portfolio is, however, becoming increasingly necessary as the portfolio’s balance shifts.

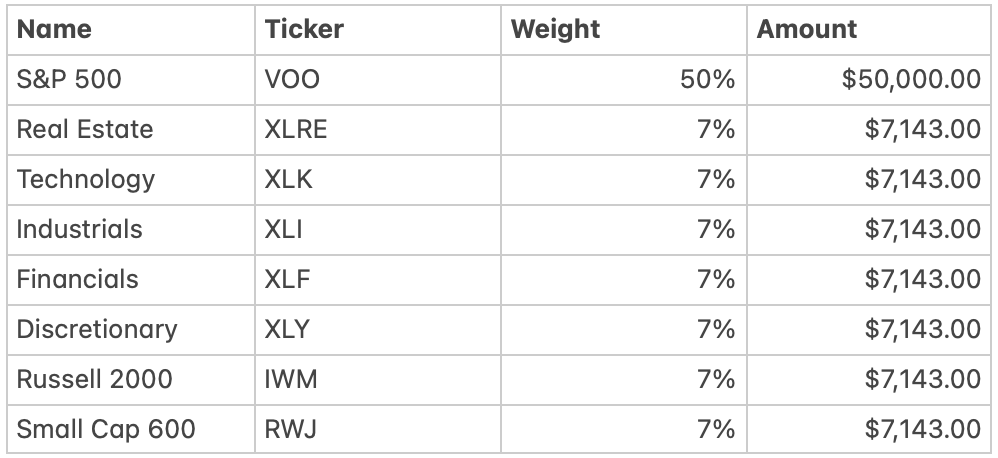

In certain instances (assuming no existing positions needed to rebalance) allocating towards sectors that will benefit from the rate cutting cycle is appropriate such as: Real Estate (XLRE), Technology (XLK), Industrials (XLI), Financials (XLF), Consumer Discretionary (XLY), The Russel 2000 (IWM), and high quality small caps (RWJ).

ALLOCATION EXAMPLE

Equity allocation approach using a $100,000 portfolio value. We want to maintain a high allocation in the S&P 500 while allocating up to 50% in other sectors that are expected to outperform. (Allocations can be adjusted to suit each individual investors preference, risk profile, tax situation). The 60 / 40 portfolios are starting to perform well now with the recent drop in rate and are expected to be a good diversifier now that the rate cutting cycle has begun.

PERSONAL ALLOCATION

My portfolio allocation is as follows. Weights have shifted from last week. It's important to note that certain of my holdings, such as HTZ and LAW, are very speculative in nature and carry a substantial degree of risk and by no means are advised. They are included to my allocation simply as a long shot, grand slam, type of scenario, should we get a very broad based small cap rally. Please note that this includes a combination of common shares and long dated options.

DISCLAIMER: The analysis is intended for educational and informational purposes about investments and does not constitute investment advice. It reflects my personal trading and may not be suitable for all investors. Always conduct your own due diligence before making investing decisions. Individual investment decisions should be made based on personal circumstances and risk tolerances. Always consult with a qualified financial advisor before making any investment decisions.